Working through a recruitment agency

One of the most common ways of working in the gig economy (as defined by JobsAware below), particularly in the health and education sectors, is through an agency.

JobsAware defines the “UK Gig Economy” as the area of the Labour Market in the UK which does not involve permanently employed workers; including but not limited to temporary agency workers, self-employed contractors and those who work flexibly for an organisation which is not necessarily their employer.

Here is some specific guidance on working via an agency, who may in turn ask you to work through an umbrella company (or your own limited company):

Working through a recruitment agency (direct contract)

A large number of temporary agency workers sign up and obtain work by registering with one or more employment agencies. These agencies find you assignments and should pay you in accordance with the terms agreed with you.

In this case, the recruitment agency will be responsible for deducting Income Tax, National Insurance Contributions (NIC) and other statutory deductions from your pay via PAYE.

There are generally three parties involved in this relationship:

- the worker;

- the recruitment agency (that is, the organisation who identifies the needs of the client and organises the provision of the worker); and

- the end client (that is, the person or business who requires the services).

A typical arrangement between these parties takes the following form:

- the worker will have a contract with the recruitment agency;

- the worker/client will complete a time sheet (or equivalent) for the recruitment agency to confirm the hours/days that the worker has worked;

- the recruitment agency raises an invoice to the client for the work undertaken by the worker (including all the on top costs of employment), plus any expenses agreed to be reimbursed and their fee;

- the recruitment agency then processes the gross pay element to the worker (including any allowable expenses) and deducts the necessary statutory deductions.

It is important to note that in some instances, agency workers are not the employees of either the agency they work for (unless they are given an overarching contract of employment), nor the end client. However they are ‘workers’ for employment law purposes in terms of their relationship with the recruitment agency and in addition, have certain additional rights conferred on them under the Agency Worker Regulations.

For tax purposes, they are usually deemed to be employees of the recruitment agency, meaning the recruitment agency should operate PAYE on their wages (assuming they are under supervision, direction or control of any person). You can find HMRC’s guidance on supervision, direction or control on GOV.UK.

Agencies are expected to report any payments made where they do not operate PAYE to HMRC. They also need to provide details of the workers and why PAYE was not used.

Where a recruitment agency has to operate PAYE, they must also pay employer NIC. This is a cost to the recruitment agency, but it is usually covered in the fee that is charged to the end client by the agency.

Even though you may work on lots of different engagements and may incur substantial travel costs in getting to your various work locations, another special tax law rule says that agency workers are not normally entitled to tax relief on the travel and subsistence expenses they incur. This is one of the reasons for the growth in umbrella companies – more on these below.

Working through an umbrella company

Often workers are asked to sign contracts with umbrella companies when they undertake work through a recruitment agency. It isn’t against the law for agencies to ask workers to do this, although when they pass you over to an umbrella company they should make sure they also hand over sufficient funds to cover all the employment costs that the umbrella company will now have.

It is also essential that the agency provides you with a Key Information Document (KID) that will set out full information including pay to enable you to make a decision on whether to work through an umbrella company.

If you work through an umbrella company, normally they will become your legal employer by providing you with an overarching employment contract. However, the agency will continue to send you on temporary assignments to the organisations.

This means that you get access to the full suite of ’employee’ employment law rights (although note that many of the ‘extra’ rights that come with employee status require a certain length of service that may not be easily be achieved in temporary work). You should also have PAYE operated on your wages (although there are a lot of non-compliant models out there which means that this does not always happen).

Having a ‘core’ employment with an umbrella company means that the various end user client sites turn into ‘temporary workplaces’ under special tax rules and means that legitimate expenses of travel to those workplaces from home might, in very limited circumstances, be allowable for tax (basically only if you are not subject to supervision, direction or control).

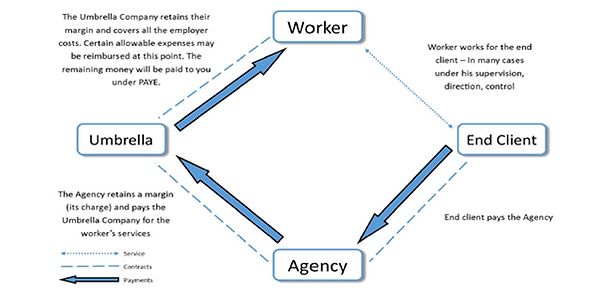

A typical umbrella arrangement involves four parties:

- You, the worker

- The recruitment agency (that is, the organisation who identifies the needs of the client and organises the provision of the worker)

- The umbrella company (who has an agreement with the recruitment agency and the worker), and

- The end client (that is, the person or business who requires the services)

A typical arrangement between these parties takes the following form:

What if I have a problem with a recruitment agency or umbrella company?

If you have a problem with an agency, then you can complain to the Employment Agencies Standards Inspectorate (EAS) or contact JobsAware.

There are a huge number of umbrella companies out there and so the marketplace is very competitive. At the time of writing the industry is not regulated, although the government has committed to this. There two things taken together mean that so umbrella companies can act unscrupulously, for example, by saying that you are not under supervision, direction, or control in order to process travel expenses, by putting you in a hybrid model – where you are treated as employed for tax purposes, but self-employed for employment law purposes, or by paying you using ‘non-taxable’ amounts like loans, grants, advances, or investment payments.

Not all umbrella companies act like this, but you should ensure you check any arrangements carefully. In particular you should be aware that public bodies are not bound to secure procurement from ‘ethical’ bodies, so the fact that you work for end clients in education or health, does not offer you any specific protection.

If you are in an umbrella arrangement that you are concerned about, please report them to JobsAware.

Working through your own limited company

Sometimes, a hirer, recruitment agency or umbrella company might ask you to work through your own limited company. Historically, doing this has helped to remove risk, costs, and burdens from the hiring business.

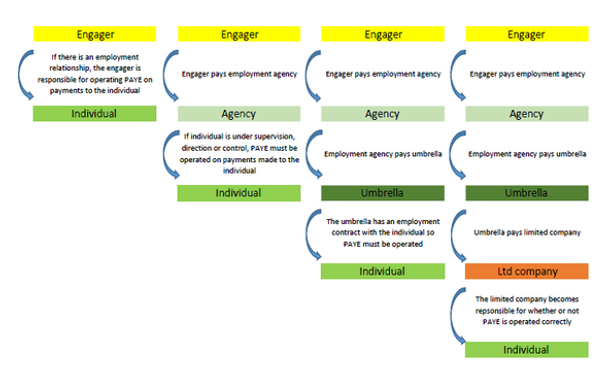

This diagram helps explain why supply chains involving temporary workers have sometimes gotten very long, sometimes resulting in workers being asked to work through their own limited company:

However, setting up a limited (Ltd) company (or allowing one to be set up for you) is very different from working through an agency or umbrella or just being an employee or self-employed.

A business which is run as a Ltd company will be owned and operated by the company directors. The company is recognised in law as having an existence which is separate from the person(s) who formed the company and from the directors/shareholders. A company is liable to pay corporation tax on all ‘profits’. A company must file accounts in a specific format to Companies House and file corporation tax returns to HMRC.

In your personal capacity, you will be a director/shareholder of the Ltd company and also the person that the company hires out to provide services (you would usually set yourself up as an employee of the company to do this). As such, you may be receiving income from the company in the form of a salary paid under PAYE and/or dividends – which can be taxed at more beneficial rates than salary.

However, many people consider it unfair that although an individual may be essentially doing the same job as an employee, they can pay a lower amount of tax by working through a limited company. Because of this, you will have to consider the impact of the intermediaries’ legislation (commonly known as IR35 / the off payroll working rules). Basically, these rules say that if you look like an employee for the hirer that you work for (the term end client is used to refer to the entity for whom you actually do the work), then you should pay tax like an employee. However, because it is only a ‘deemed’ employment relationship, you won’t get any of the employment rights that usually go along with being an employee.

The off payroll working rules have applied to those providing their services to organisations in the public sector since 2017, and to medium and large clients in the private sector (that is, those that meet 2 or more of the following conditions: annual turnover of more than £10.2 million, a balance sheet total of more than £5.1 million, more than 50 employees) since April 2021.

The off payroll rules mean that PAYE tax and National Insurance will have to be operated on the amount paid to the company for your services, by whichever entity is responsible for paying your limited company. You should then be able to draw out the money from the company as either a salary or dividends without further deductions. You can read more about the requirements on gov.uk.

The hirer that you work for is responsible for deciding whether you look like an employee (as opposed to a genuinely self-employed person), by applying the general ‘status’ tests. If you are a lower-paid worker, you are not likely to have much autonomy over the work that you do for them, so you will probably be determined to look like an employee.

This is really the key difference between the off-payroll rules and the ‘old’ rules. Under the old rules (known as the ‘IR35’ rules), the decision as to whether you look like an employee or not rests with your own limited company, whereas under the new rules, the hirer makes the decision instead (with ramifications if they get things wrong). This makes it much more likely that the rules will be applied properly and that everyone will then pay the correct amount of tax and National Insurance in accordance with the law.

The new rules, mean that there may no longer be any incentive for a hiring business to ask you to work through a limited company. Indeed, there will likely be more potential costs and complexity in supply chains involving limited companies. If you are a lower paid worker being asked to work through one – you probably need to ask yourself why.

Those providing their services to ‘small’ clients in the private sector will still need to consider whether the old IR35 rules apply to them – these haven’t just fallen away altogether post April 2021.

Where can I find more information?

You can find some guidance on working through an agency on GOV.UK.

There is information on running a limited company on GOV.UK.

You can find a useful outline of the main things to consider if you are asked to work through an agency, an umbrella company or your own limited company on the LITRG website.

You can read more about working through umbrella companies in the LITRG factsheet on working through an umbrella company.

The LITRG factsheet covers a range of issues on which workers are likely to have questions including holiday entitlement and other employment right issues, the availability (or otherwise) of travel expense relief and why they may have been handed over to an umbrella company by an agency in the first place. It includes a helpful diagram explaining how umbrella companies work, a sample payslip to help demystify the sometimes confusing payslip entries and links to more help.

Very importantly – on the basis that workers passed to an umbrella company should be offered an ‘umbrella rate’, which should always be higher – it includes a ‘ready reckoner’ to help workers understand whether the rewards they are being offered through an umbrella company are roughly equivalent to what they might have otherwise received, once the various deductions the umbrella company has to make have been considered.